"I Don’t Need Insurance Right Now" – The Cost of Waiting

Introduction

Many people believe that life and health insurance are things to consider later in life. But the truth is, the earlier you plan, the better protected you are.

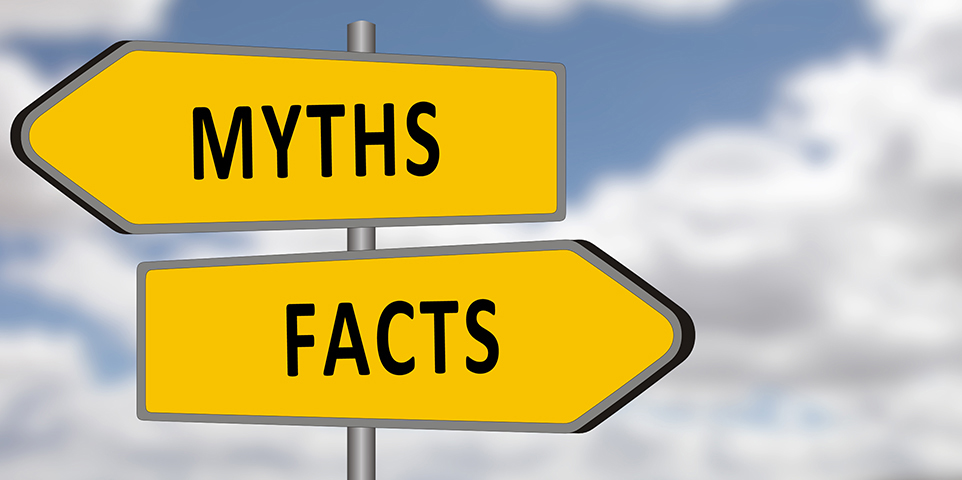

❌ Myth: "I’m young and healthy, I don’t need insurance."

✅ Reality: Accidents and illnesses can happen at any age. Getting insured while you're healthy

means lower premiums and better coverage.

❌ Myth: "I don’t have dependents, so I don’t need life insurance."

✅ Reality: Life insurance can protect you from debts, future family planning, and even serve as

an investment tool.

❌ Myth: "I can always get insurance later."

✅ Reality: As you age, premiums increase, and medical conditions may make it harder to

qualify for coverage.

Final Thought:

Insurance isn’t about today—it’s about securing your future while it’s affordable and accessible.